The Swimming Pool Insurance Policy Nobody Wants to Use

Mandated Building Insurance: The Victorian Domestic Building Insurance (DBI) scheme is commonly known as a policy of ‘last resort’.

This means that unless a building project cannot be completed, or has defective works which cannot be rectified, as their builder has; died, becomes insolvent, disappears or fails to comply with an order made by the DBDRV, VCAT or a Court - then it's up to you to resolve a major dispute.

Generally speaking, this means having to go through the:

- Domestic Building Dispute Resolution Victoria (DBDRV)

- Victorian Civil Administrative Tribunal (VCAT)

- Involve a range of Government Agencies

- Engage an independent building dispute consultant

- Litigate through the Court system

Going down any of these roads is something to be avoided. The reality is there are several thousand formal disputes in Victoria every single year, slowly churning through the above processes. And most of these options are stressful and expensive - which underlines the importance of appointing the right builder in the first instance.

Registered Victorian Builders are required to purchase DBI on behalf of homeowners for all projects valued in excess of $16,000. The builder is also obliged to give a copy of the policy to the homeowner.

Here's an excellent Explainer Clip issued by the Victorian Managed Insurance Authority (VMIA). The VMIA is the State insurer who ultimately administer the DBI program. Like most insurances, DBI is a policy nobody wants to have to use.

Caution 1: It’s important not to confuse DBI with other insurances. Even though your builder may say they're ‘covered’ or ‘they've got insurance’ you shouldn’t automatically assume that the project has DBI. Builders should take out a range of additional insurances, such as public liability, contract works, etc.

Caution 2: Don’t allow work to commence until you have a copy of the DBI policy.

Limitations

DBI covers costs up to $300,000 to rectify:

- Structural defects, for six years.

- Non-structural defects, for two years.

If you claim on the policy for work that was not completed:

- You may find your claim is limited to only 20% of the contract price.

- The policy will not cover your advance payments.

Generally speaking, Victorian building law currently allows for an action to be brought against a builder within 10 years of the occupancy permit or the certificate of final inspection. Being accountable however is not the same as being responsible.

A builder is only responsible if their building work can be proven to be: incomplete, defective, not completed to a satisfactory standard, not compliant with the regulations or BCA, or not built as required by the contract. DBI was previously known as Builder Warranty Insurance, I believe both names create a level of (questionable) comfort in the mind of consumers. Comfort that ‘if things go wrong’ the homeowner can just 'sack' the builder and find someone else to finish the job. This is generally not the case.

As the building contract provides an ongoing warranty for several years to come it’s vitally important to select the right builder. In many respects you’re contractually ‘married’ to them for 10 years.

For current legislation, updated advice & queries visit: Victorian Managed Insurance Authority - Consumer Affairs Victoria - Victorian Building Authority

Note: Though this information was accurate at the time of writing be aware that regulations and processes change frequently - check with your insurer and State regulator for current factual information.

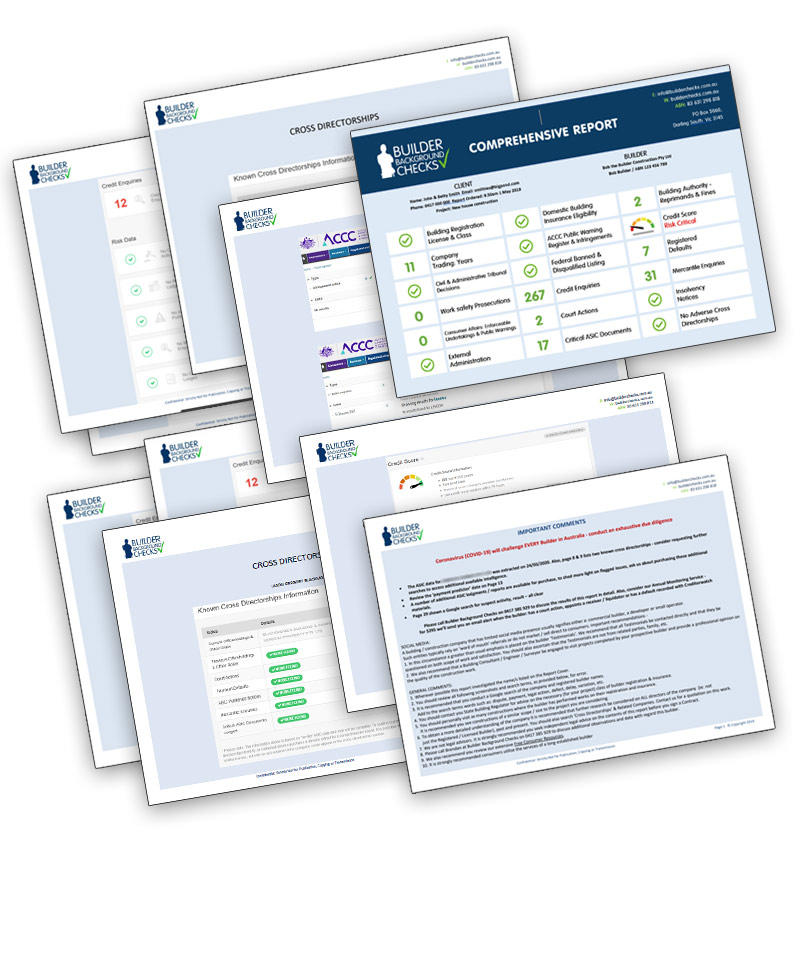

We've helped hundreds of Australians complete their due diligence with our unique range of credit rating, defaulting, company & court records. We also search hard-to-find regulatory, insurance, social & government records to ensure our clients avoid repeat-offending builders. If you're about to build, or extend credit to builders, we'll do your homework for you.

Disclaimer: Builder Background Checks P/L (BBC) provides advice of a general nature only. BBC does not provide formal legal, regulation or building advice. The advice published has been prepared without taking into account your specific objectives or needs. Before acting on any commentary, articles or reports provided by BBC you should consider their appropriateness to your specific objectives, financial situation and requirements. BBC shall not be liable to any party as a result of any information, services, or resources made available as part of its reports or articles contained on this website.